From Infrastructure to Adopters: The Next Phase of the AI Boom

Back in October, I shared research from Kai Wu, founder of Sparkline Capital, that pointed out the Achilles heel of the AI Boom. The builders of AI infrastructure — everything from the data centers to the core large language models themselves — were deviating from their capital-light, high-margin software and services businesses and pivoting to what is becoming a low-margin, capital-heavy utility business.

It took a few months, but Wall Street appears to now share his view. Investors punished Microsoft for its heavy capital spending following its earnings release last week, asking (with justification) whether any of it would generate the profits they’d hoped for.

Wu’s piece is still spot on… and if you haven’t read it yet (or even if you have!) I recommend you do so today.

The AI revolution is real but it’s important to understand who actually benefits from it. The companies that built the original internet infrastructure of the 1990s weren’t the ones that benefitted. It was the adopters that came later — Amazon.com, Neflix, YouTube, etc. — that built game changing businesses that continue to mint money today.

It will be the same this time around too. It’s the AI adopters that will be the real winners.

That’s my view… and it also happens to be Wu’s. In his annual letter, Wu lays out his thesis for investing in the AI adopters over the infrastructure builders. I’ve republished an excerpt below. You can view the letter in its entirety here.

Enjoy!

Charles

AI Adopters: Beneficiaries of the Boom

Executive Summary

Our annual letter discusses how we are investing in the AI revolution. We believe we are now approaching the “adoption phase” of the boom, a period during which early adopters of AI will begin to separate from their laggard peers on the back of tangible AI-driven gains. The Funds are increasingly focused on these early adopters, which offer AI exposure without the elevated valuations and capital spending of the AI infrastructure stocks that now dominate the S&P 500.

From Buildout to Adoption

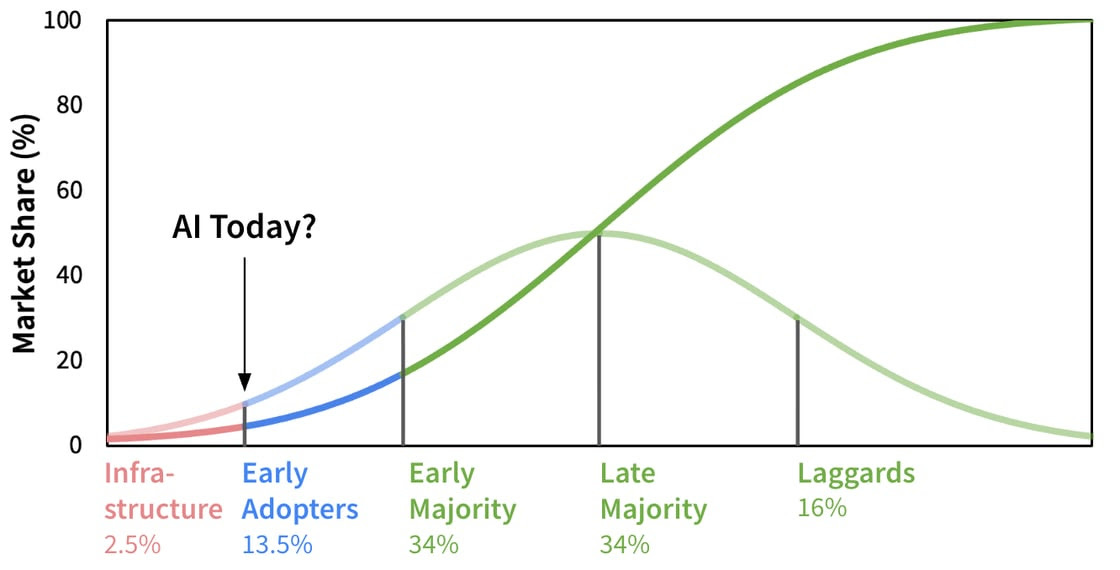

We believe the AI boom is shifting from the buildout to adoption phase, during which leadership has historically broadened from infrastructure to early adopters.

Source: Sparkline. Adapted from Rogers (1962).

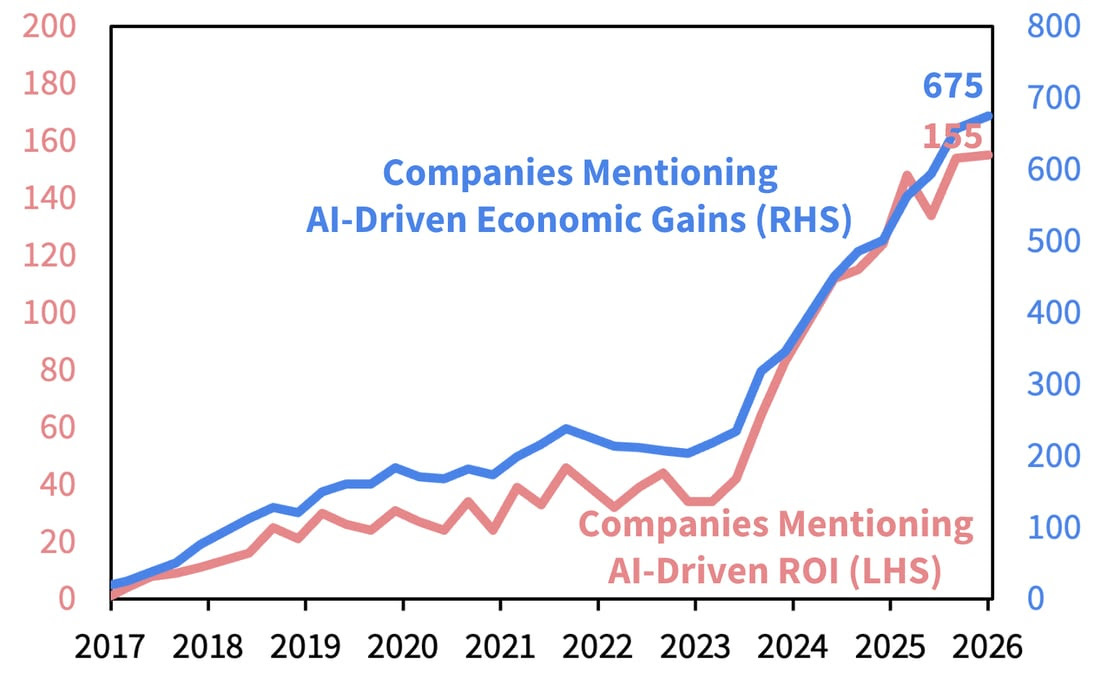

More Firms Reporting AI-Driven ROI

While it is still early, we are starting to see evidence of adopters’ AI investments bearing fruit - a trend we expect to accelerate in subsequent years.

Source: S&P, Sparkline. From 12/31/2016 to 12/31/2025.

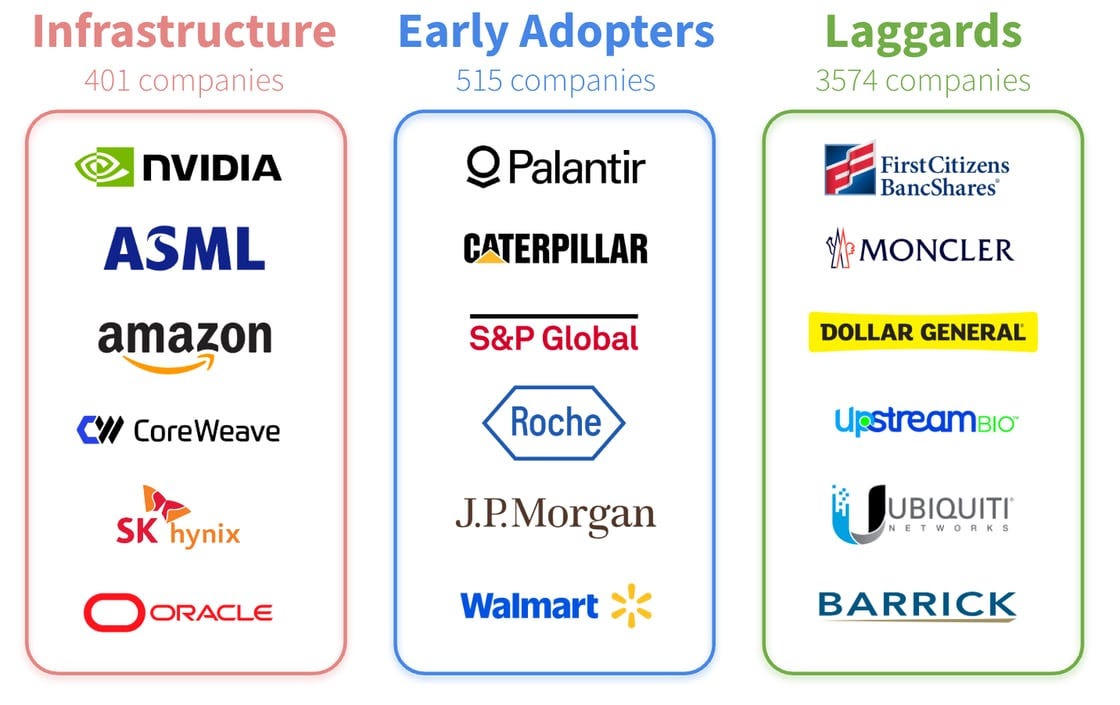

Finding Early Adopters

We use data on corporate AI investment and supply chains to create a taxonomy consisting of AI infrastructure, early adopters, and laggards.

Source: S&P, Sparkline. As of 12/31/2025.

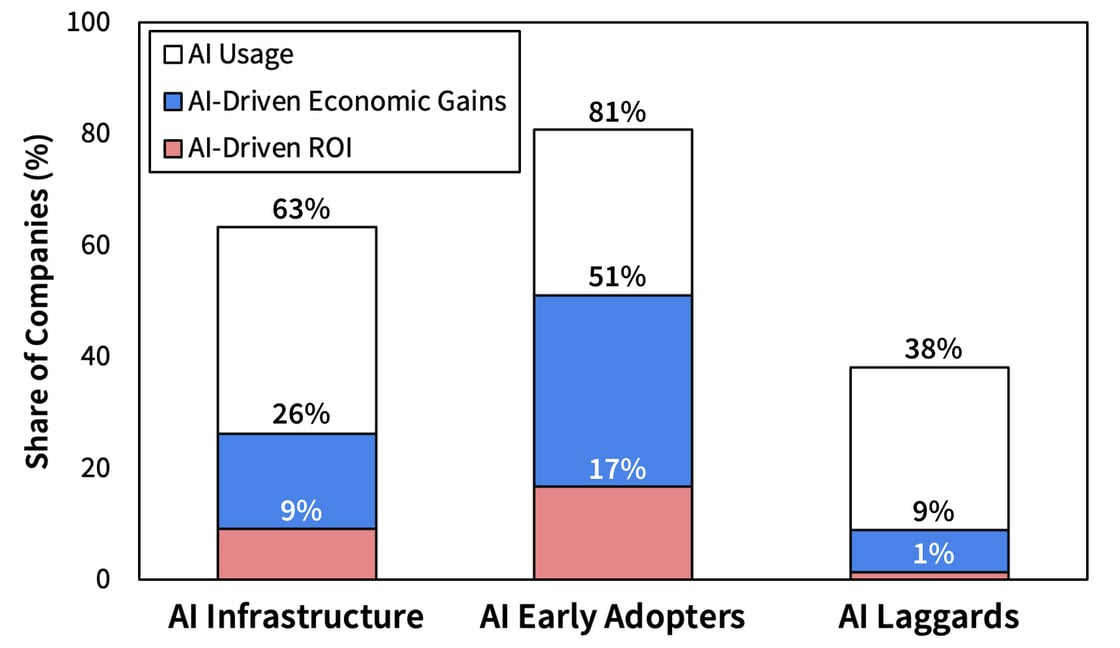

Early Adopters Report AI-Driven ROI

Early adopters are reporting significantly more tangible AI-driven gains than their laggard and infrastructure counterparts.

Source: S&P, Sparkline. As of 12/31/2025.

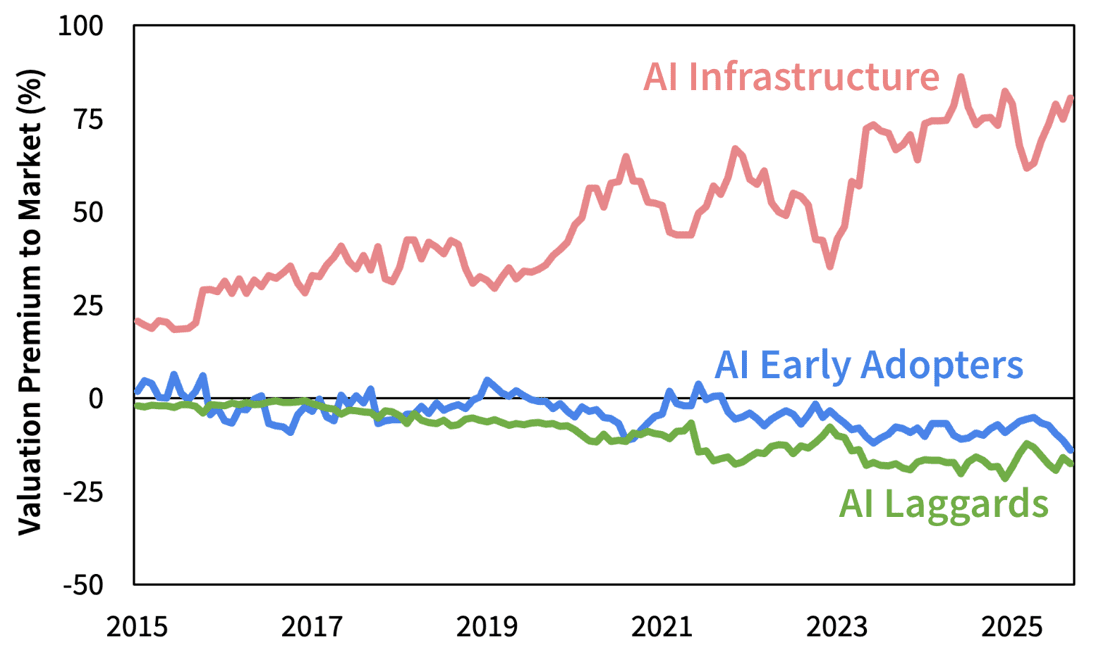

Early Adopter Valuations Subdued

Unlike infrastructure firms, early adopters are not being rewarded for their AI investments - their valuations are similar to those of their laggard peers.

Source: S&P, Sparkline. From 12/31/2014 to 12/31/2025.

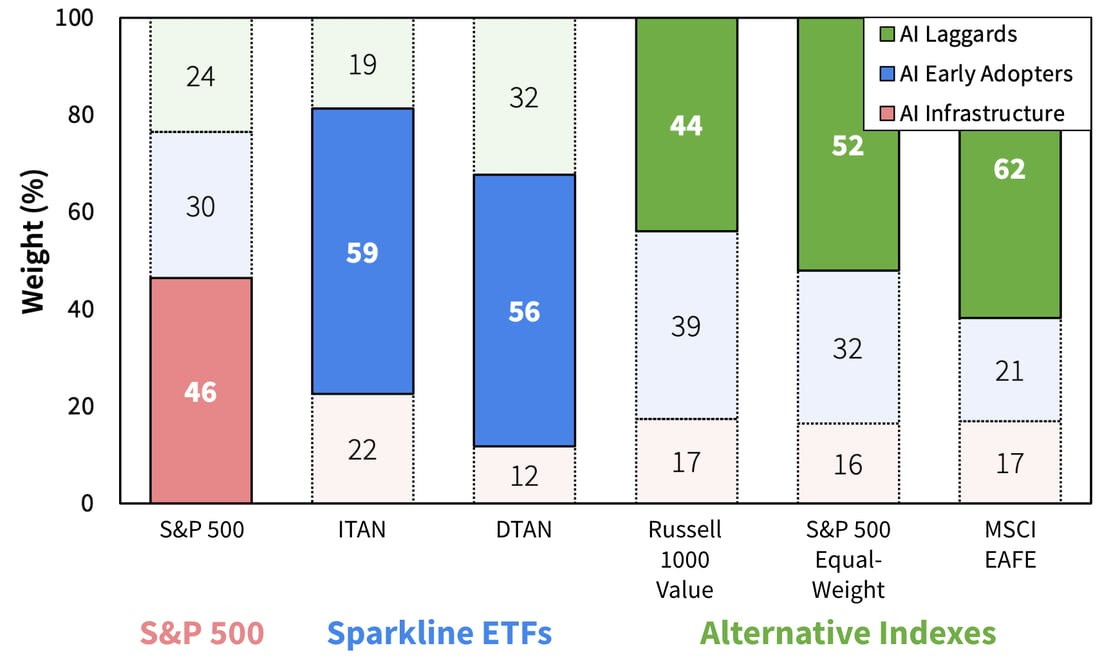

Infrastructure Dominates S&P 500

The S&P 500 is heavily concentrated in risky AI infrastructure stocks, while popular alternatives (e.g., value stocks) are dominated by AI laggards. The Sparkline ETFs offer a third path - AI early adopters.

Source: S&P, Sparkline. As of 12/31/2025.

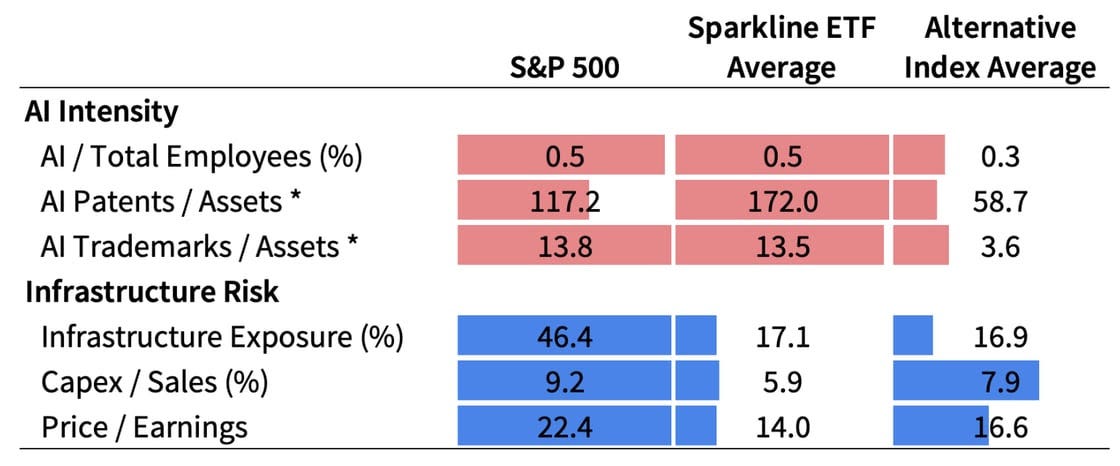

AI Exposure Without the Infrastructure Risk

ITAN and DTAN, with their focus on AI early adopters, provide exposure to AI’s transformative potential without the concentrated infrastructure risk of the S&P 500.

Source: S&P, USPTO, LinkedIn, Sparkline. As of 12/31/2025.

You can view the full client letter here.