Model 401k Allocation

We’re in the late stages of a stock market bubble.

I’ll save you a lengthly rehash… if you want a summary, I encourage you to watch the presentation I made to investors last month. But by virtually every commonly-used valuation metric (price/earnings, price/sales, dividend yield, etc.), this is either one of the most expensive markets in history or literally the most expensive.

We know this to be objectively true.

But what do we do about it? How do we allocate our portfolios?

Well, that’s the fun part.

At this stage of the bubble, you have to balance two core risks:

The risk that the bubble bursts and your stocks and other risky assets take major losses — the kinds of losses that might take a decade or more to recover.

The risk that expensive stocks become even more expensive and you miss a generational opportunity to pad your net worth. (This is the fear of missing out, or FOMO.)

The first risk is easy to quantify. In the 2000-2002 bear market, the S&P 500 lost nearly half its value and the Nasdaq lost close to 80%. And in 2008, the S&P 500 lost more than 56% of its value.

Some of the highfliers from the 1990s tech bubble — including household names like Cisco Systems and Intel — are still below their 2000 highs more than 25 years later.

No one wants to live through something like that. It’s utterly miserable and soul crushing.

But that second risk — the fear of missing out — isn’t exactly a picnic either. There is a lot of money to potentially be made in the epic blow-off top of a bubble.

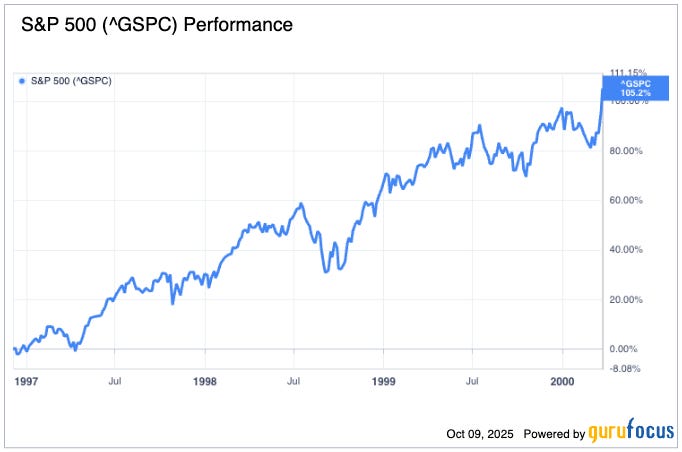

Former Fed Chairman Alan Greenspan famously identified the “irrational exuberance” of the 1990s. But contrary to popular belief, he didn’t utter those words near the top. He first said them on December 5, 1996.

And what happened?

The S&P 500 went on to double again before eventually crashing.

Performance of S&P 500 Immediately Following “Irrational Exuberance”

And here’s the real kicker…

The S&P 500 closed at 744 on December 5, 1996. Despite dropping by nearly half, the S&P 500 never fell below those levels during the 2000-2002 bear market. (It fell below those levels in 2009 in the final throws of that bear market but only for a few days.)

So, getting out of the market when Greenspan (correctly) noted that it was in a bubble wouldn’t have saved you from losses. It would have saved you a breakneck round trip, of course. And you could have potentially invested in something other than stocks during that period and potentially made a lot more money. But it’s safe to say that selling everything and hiding in a cave would have been a mistake.

Great.

What about today?

I have a pretty good idea of how this bubble burst. Given how circular and interconnected the AI economy is, eventually one of the major players will have a bomb of an earnings release, Wall Street will realize that AI infrastructure is overbuilt, and the whole thing will implode.

But I don’t know when that happens. It might be tomorrow or it might be three years from now. I expect the market to be chopped in half… but it might double again before that happens.

So, this becomes an exercise in balancing the risk of loss with the risk of missing out.

Model 401k Allocation

This is what I recommend for a “typical” 401k allocation given today’s market conditions. I would consider this a reasonable allocation for a worker in their prime earnings years (late 40s to early 60s). Obviously, one size does not fit all, and your ideal allocation is going to be based on more than just your age. (I can’t give tailored advice in a general post like this, but if you’d like to have a no-obligation portfolio risk assessment, please reach out. We can go over your specific situation and discuss options.)

Not all 401k plans will have access to all of these asset classes. But this should at least get you a start: