Sometimes They Really Do Ring a Bell

5X-Leveraged ETFs are the latest Wall Street innovation destined to end badly

I’ve always believed the old Wall Street maxim that they never ring a bell at the top of a bull market.

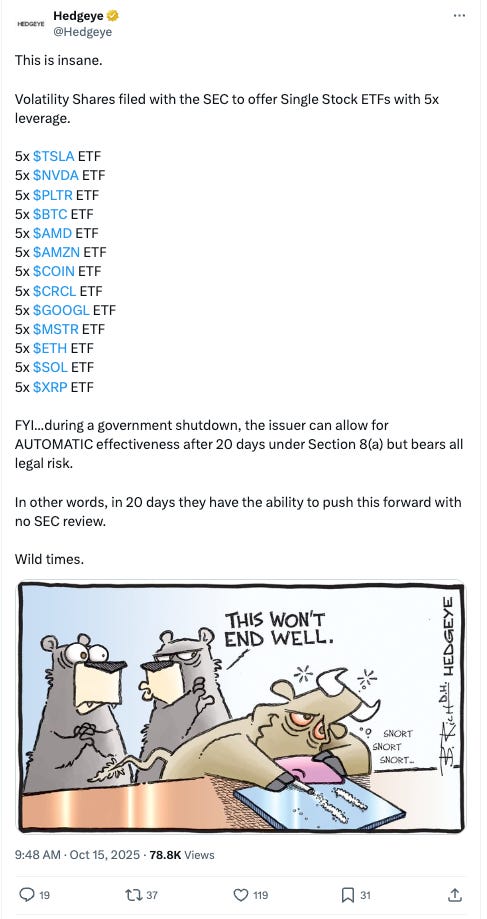

And then I saw this come across my screen this morning:

On second thought, maybe they do ring a bell at the top.

This isn’t an internet spoof. It’s real.

I’m a big believer in allowing people to take risks and to enjoy the payoff (or suffer the loss), s…